(Japanese original published on 19 May 2023)

According to trade statistics from the Ministry of Finance, Japan's trade balance for FY2022 recorded a trade deficit of over 21 trillion yen. This is due to the dual effects of global inflation, as represented by soaring fossil fuel prices, and the record depreciation of the yen. Imports of energy and resource-related goods are notably large, with imports of mineral resources such as petroleum and natural gas exceeding 35 trillion yen in FY2022.

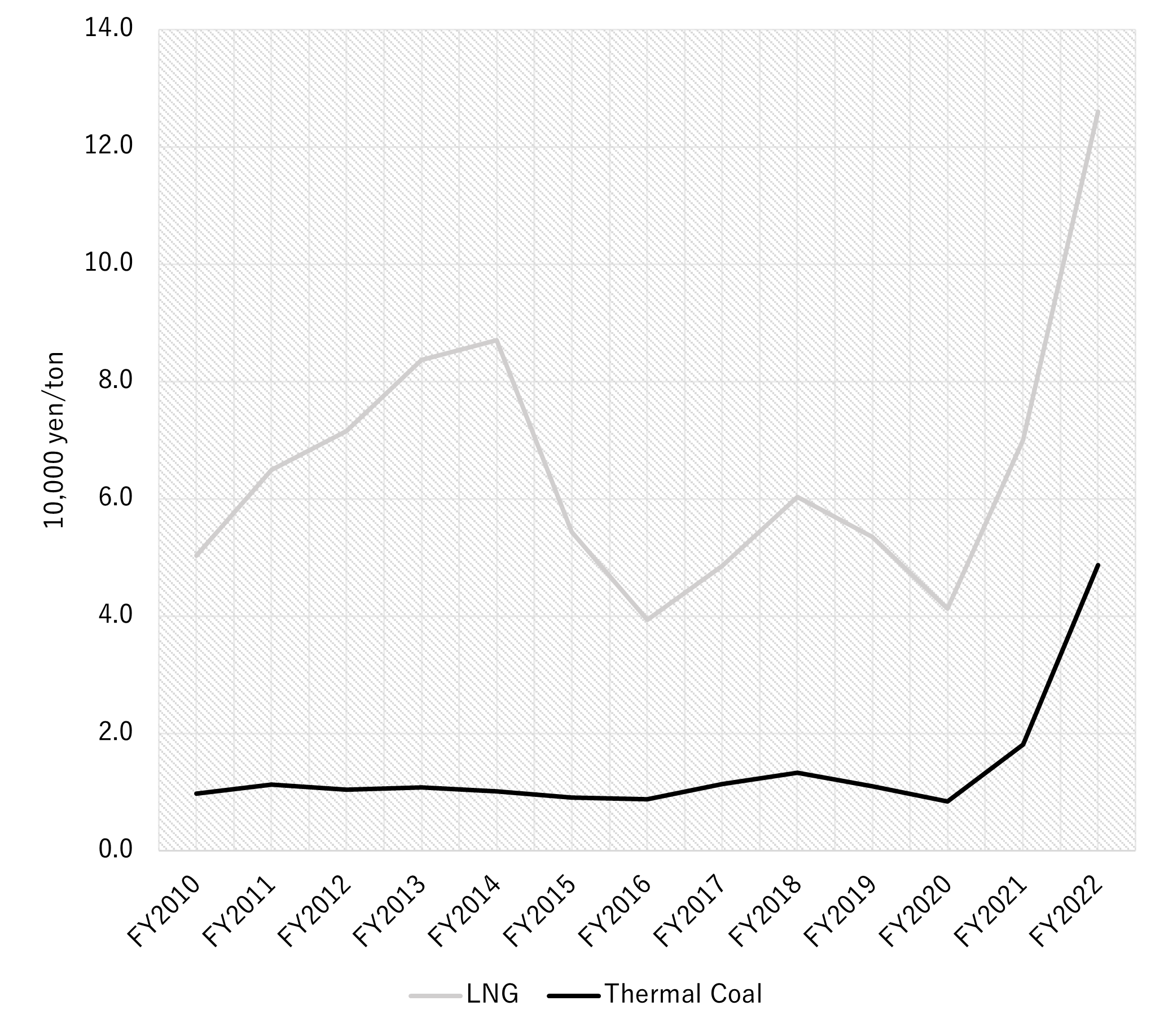

The tremendous impact of price hikes is strikingly evident when we take a look at the trends of import price for fossil fuels over the years, in particular, LNG and coal, which are mainly used as fuels for thermal power generation (Figure 1). The average unit import price of LNG has more than doubled from 60,000 yen/ton in FY2019 to 126,000 yen/ton in FY2022. The surge in thermal coal prices has been even more dramatic: for the 10 years from FY2010 to FY2020, the unit price remained flat at around 10,000 yen/ton. By FY2022, however, it soared nearly five-fold, to 49,000 yen/ton.

Figure 1. Import Price per Ton

How did the demand and supply of electricity in FY2022 react to this surge in fossil fuel prices? We will review this by looking into the power supply-demand data released by Japan's general transmission and distribution operators.

First of all, total electricity demand in FY2022 was 870 TWh (1 terawatt-hour = 1 billion kWh). In contrast, the amount of electricity supplied was 872 TWh. Of this, thermal power accounted for the largest share at 632 TWh (73%), followed by renewables at 186 TWh (21%), and finally nuclear power at 54 TWh (6%). This shows that Japan still relies heavily on thermal power generation for the majority of its electricity supply. In contrast, only a small amount is supplied by nuclear power.

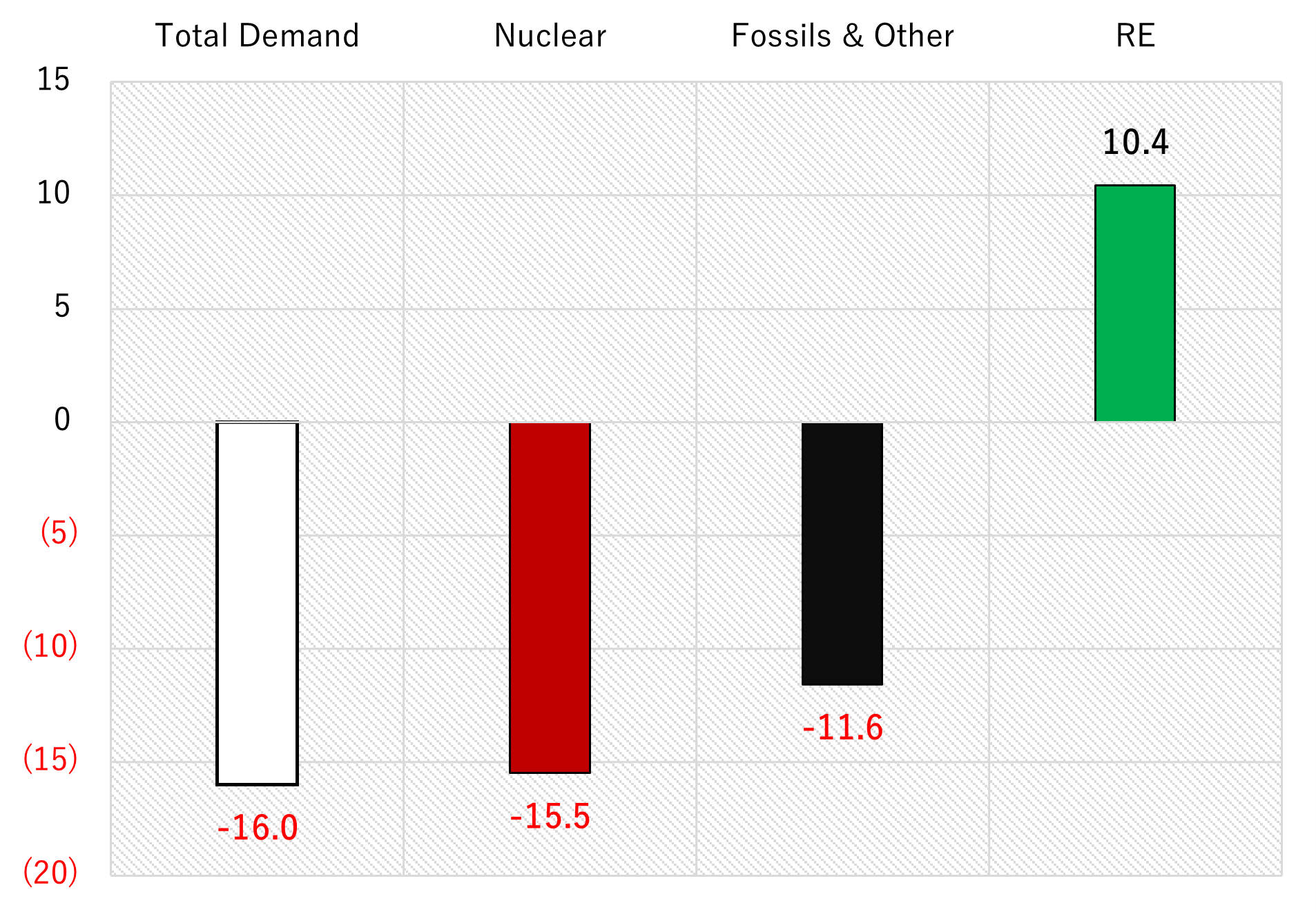

Particularly interesting to note is the change in supply and demand from FY2021. Fossil fuel price hikes have rapidly occurred between FY2021 and FY2022. How has electricity supply and demand changed in response to this situation? Figure 2 shows the year-over-year changes.

Figure 2. Changes in Electricity Supply and Demand in FY2021-FY2022 (TWh)

This data uncovers several things.

Firstly, the total demand fell by 16 TWh in FY2022 compared to the previous year. One of the reasons for this decrease could be related to the temperature. The January-March period in FY2022 was higher in temperature than the same period in the previous year1 having the effect of reducing heating electricity demand. However, the July-September period of FY2022 was hotter nationwide than the same period in the previous year, which will, in contrast, have the opposite effect of increasing cooling electricity demand. From this, we can conclude that weather conditions contributed both to an increase and decrease in power demand. Another possible factor affecting to the overall decrease trend is the impact of electricity price hikes. By the second half of FY2022, electricity prices increased by more than 30% year-on-year.2 The sharp rise in electricity rates is likely to have had an impact on the behaviour of electricity consumers who will have an incentive to reduce their electricity consumption. Perhaps due in part to this, electricity demand has been declining year-on-year in most months through the second half of the fiscal year.

Secondly, on the supply side, renewables continued to grow. Renewables steadily rose by 10.4 TWh in FY2022 compared to the previous year. Of this increase, the largest share, 7.4 TWh, came from solar PV. We can assume that the increase in the supply of renewables has without doubt, contributed to mitigate the surge in electricity prices, as it reduces the supply from other sources.

The combined effect of the decrease in electricity demand and the increase in the supply of renewables described above indicates that thermal power generation would have had the effect of decreasing by 26.4 TWh. However, the actual reduction in thermal power supply was only 11.6 TWh. This is because nuclear power, which is considered to be a reliable power source that ensures steady supply, reduced its supply by 15.5 TWh compared to FY2021.

This is due to two factors. First, nuclear power plants must be shut down and undergo periodic inspections every 13 months. In FY2022, all of Kansai Electric Power's nuclear power plants and Kyushu Electric Power's Genkai nuclear power plant underwent periodic inspections, resulting in low facility utilization rates. Second, operational trouble occurred at the Takahama Unit 4 nuclear power plant at the end of January 2023, causing the plant to be shut down during the high power demand winter period which continued until late March. These two factors led to the drop in the supply of nuclear power amid soaring electricity prices.

Periodic inspections are necessary to ensure safety, and operational problems can occur with any power source, not just nuclear power. However, nuclear power plants are particularly required to take strict measures to ensure its safety. Periodic inspections are extremely important, and shortening the intervals of periodic inspections on the grounds to meet electricity demand is inappropriate. Furthermore, since the output of each nuclear power plant is large, its shutdown would have a large impact on the overall power supply. It should be recognized that nuclear power has these drawbacks, even though it has developed its reputation as a power source that provides stable supply. At the very least, it is true that nuclear power has failed to demonstrate its effectiveness against the soaring price hikes in FY2022.

On the other hand, on the electricity demand side, electricity consumers responded to the market by driving their behaviours towards energy efficiency and energy savings, hence contributing to reducing energy demand. Renewables have also increased their supply steadily, and mitigated against the 2022 fossil fuel price spike. In particular, solar PV, with its high flexibility in installation and short lead time, proved to be effective in increasing supply in a short period of time.

The high electricity prices that occured as a result of the surge in fossil fuel prices in 2022 are a signal from the market. To be able to respond and address to the situation in a shorter time frame and with more flexibility is important from an energy security perpective. Ensuring energy security in tandem with promoting decarbonization, is an aspect that needs to be taken into account.

- 1Japan Meteorological Agency, "日本の地域平均気候表 (Regional Average Climate Chart for Japan)”

- 2Calculation based on "電力取引報結果 (Electricity Transaction Report Results)" by the Electricity and Gas Market Surveillance Commission.